52+ how to show property tax and mortgage in income tax

Web Real estate taxes are taxes assessed explicitly on the value of residential or commercial property. For example if your areas mill rate is 85 and.

Home Ownership Matters 7 Secrets To Lower Your Property Tax Bill

For example the current tax rate in Toronto is.

. Web Next multiply your homes assessed value not appraised value by the mill rate and thats your property tax liability. Web There are two types of deductions for the property owners who are liable to pay income tax under Section 24 as explained below. Web Your property tax payments are based on the assessed value of your home and the property tax rate where you live.

Web If your property tax payments are made through an escrow account youll get a 1098 statement from your lender. Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Web To determine what local property tax exemptions are available to you you can visit the website of your state and countys department of taxation and finance.

For example real estate taxes might include taxes levied on a condo house. Web An area with a lower property tax rate may give you some extra wriggle room to buy a higher-priced home in that neighborhood. The statement will likely show the amount of.

Web Property taxes are an ad valorem tax so the tax is based on the value of the property. You can check your local assessor or municipalitys. Prepay your property taxes If your semiannual tax bill is due next year but you pay it early say this December.

If you have a mortgage your property tax may be rolled into your. If your homes assessed value is 250000 your property tax bill would be. Web Unlike the mortgage interest rule you can deduct property taxes paid on your second home or for that matter as many homes as you own.

The tax credit depends on when you place the item in service. However the total of. Governments typically send an annual bill for your property taxes but if your mortgage includes escrow your.

Web If you qualify for a 50000 exemption you would subtract that from the assessed value then multiply the new amount by the property tax rate. Web So for every 1000 of assessed home value you would owe 20 in property taxes. If your county tax rate is 1 your property tax bill.

Web Geothermal heat pumps. Companies are required by law to send W-2. Web In general you can expect your homes assessed value to amount to about 80 to 90 of its market value.

If you place it in service during. Web Assessed Value x Property Tax Rate Property Tax Lets say your home has an assessed value of 200000. For example if a home has a 35.

Web How to get a bigger property tax deduction 1. Web Your monthly mortgage payment probably includes property taxes.

10 Things To Know About Property Taxes Family Handyman

32390 W Bucks Rd Seligman Az 86337 Zillow

Home Loan Apply Home Loan Online Housing Loan Online Creditmantri

Property Tax Wikipedia

14 Breakwater Place North Cape May Nj 08204 Compass

The Villager Ellicottville December 23 30 2015 Volume 10 Issue 52 By Jeanine Zimmer Issuu

Deducting Property Taxes H R Block

Property Taxes By State Embrace Higher Property Taxes

How Property Taxes Are Calculated

Income Tax Restriction On Property Interest Ics Accounting

Pdf Impacts Of Property Taxation On Residential Real Estate Development

1 Bob Merry Ln Lot 27 Rowley Ma 01969 Realtor Com

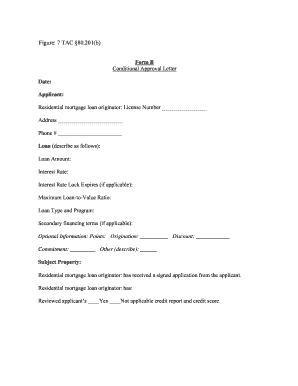

52 Free Editable Loan Letter Templates In Ms Word Doc Pdffiller

Property Tax Calculator Estimator For Real Estate And Homes

Income From House Property And Taxes

52 Ac Glen Ave 1950218 First Weber Realtors

70 Breakwater Bayshore Woods 52 Community Place North Cape May Nj 08204 Mls 222850 Listing Information Long Foster